.png)

Cultivating the habit of saving money is a cornerstone of sound financial health,

serving as a vital strategy for achieving significant fiscal objectives while avoiding the pitfalls of debt accumulation. This practice gained significant momentum during the initial phase of the pandemic, as reflected in the notable increase in average savings account balances. However, the current financial landscape presents a more complex scenario.

Despite a substantial rise in interest rates over the past few years, personal savings rates have not mirrored this trend proportionally. This discrepancy highlights a broader issue: numerous factors influence an individual's capacity to save. These factors can range from fluctuating income levels, increased living costs, and unexpected expenses, to more systemic issues like economic instability and wage stagnation.

There are various reasons why people save. Short-term goals include saving money for holidays, purchases, or renovating a house. In the long term, the most crucial reasons for putting money aside in the United States are related to the costs of the education of one's children or ensuring financial stability in retirement. However, the high inflation rates in the United States since 2021 have made it more difficult to save money.

Moreover, there is a growing body of evidence indicating a strong desire among individuals to enhance their savings beyond current levels. This aspiration, however, often clashes with the practical realities of their financial situations. To address this, it's essential to acknowledge the diverse challenges people face in their savings journey and to explore a variety of strategies that can help bridge the gap between their savings goals and their actual savings behavior.

Effective money-saving techniques are not one-size-fits-all; they require a personalized approach that takes into account individual circumstances and financial goals. By understanding and adapting to these varied factors, individuals can develop more realistic and achievable savings plans, positioning themselves for greater financial stability and success in the long term.

Total U.S. personal savings amounted to $802.1 billion as of November, 2023. The personal savings rate (personal savings as a percentage of disposable personal income) was 3.4%.

- From 1971 to 2023, interest rates averaged 5.42%. Interest rates reached an all-time high of 20% in March 1980 and a record low of 0.25% in December 2008.

- Data from the Federal Reserve shows the average American family has $62,410 in transaction accounts.

- Factors like age or education level may impact the amount the typical American actually has saved.

- The average American savings balance may also depend on household size and homeownership status.

A Forbes Advisor survey of savings habits conducted in March 2023 found that two-thirds (66%) of Americans said they were able to save money in the past year. Increased interest rates (50%) and pay increases (35%) were the most common factors helping respondents save.

The uncertain state of the economy motivates many to save, but this is only one way people are attempting to protect themselves. A 2023 report from Northwestern Mutual found that Americans are taking three major steps to address economic uncertainty: Nearly 64% of respondents are cutting costs, 50% are building savings and 41% are delaying large expenses. Each household often utilizes multiple strategies at a time.

Still, Americans face many barriers to saving and are putting away less of their income overall. According to data from the St. Louis Federal Reserve, personal savings only accounts for 4.1% of disposable personal income as of April 2023. That’s well below pandemic highs of 33.8% in April 2020 and 26.3% in March 2021 and lower than the savings rate a decade prior, 6.2% in April 2013.

And while savings interest rates are at a 15-year high, many Americans may find it difficult to take advantage of these competitive rates in the current economic environment.

Transaction account estimates can shed light on the overall banking balances of Americans. In 2022, the national per capita disposable personal income was $55,832 and the personal savings rate was 3.6%. Based on this data, Americans were able to save roughly $2,010 per person last year.

According to data from the Federal Reserve's 2022 Survey of Consumer Finances, the average American family has $62,410 in savings, across savings accounts, checking accounts, money market accounts, call deposit accounts, and prepaid cards.

Note that this number is an average, not a median, which means it can be skewed by households with especially high or low balances. This number does not include investment balances, like money held in a retirement account or other brokerage account, or any equity held in real property, like a house.

When you look a little closer at the data, there are several factors that influence how much an American household actually has saved.

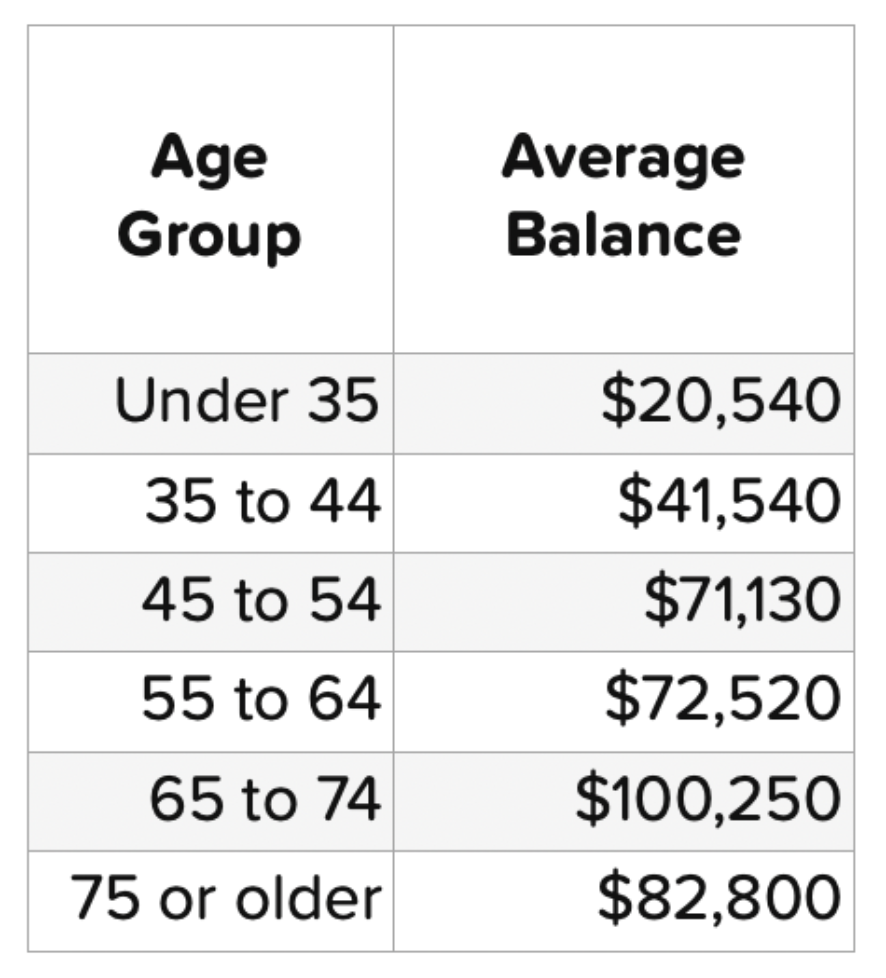

Average Savings Balance by Age

Older Americans tend to have more cash in the bank than younger Americans. The average person between the ages of 45 to 54 has $50,590 more than the average person under age 35. However, average savings account balances start to decline after age 70.

Here's how the average savings balances break down by age group, according to Federal Reserve data:

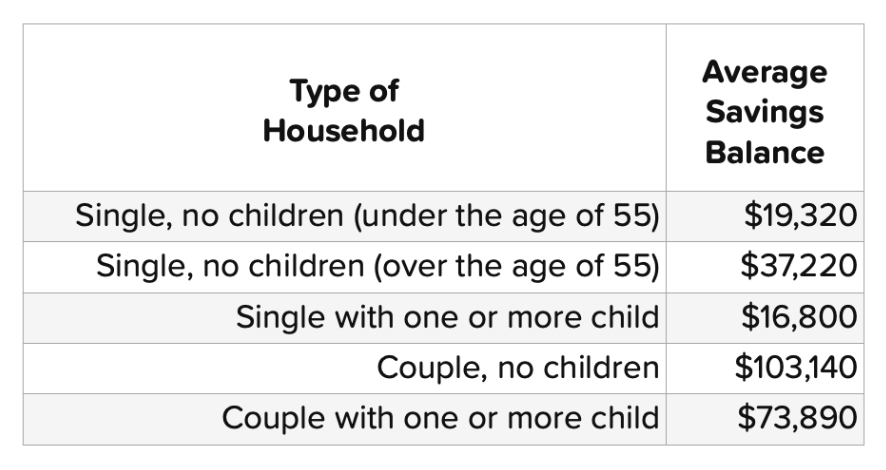

Average savings balance by household size

Kids and marriages tend to dramatically change a family's household savings balance.

On average, single-parent households under the age of 55 tend to have the lowest average savings balances, while couples without children tend to have the highest average savings balances.

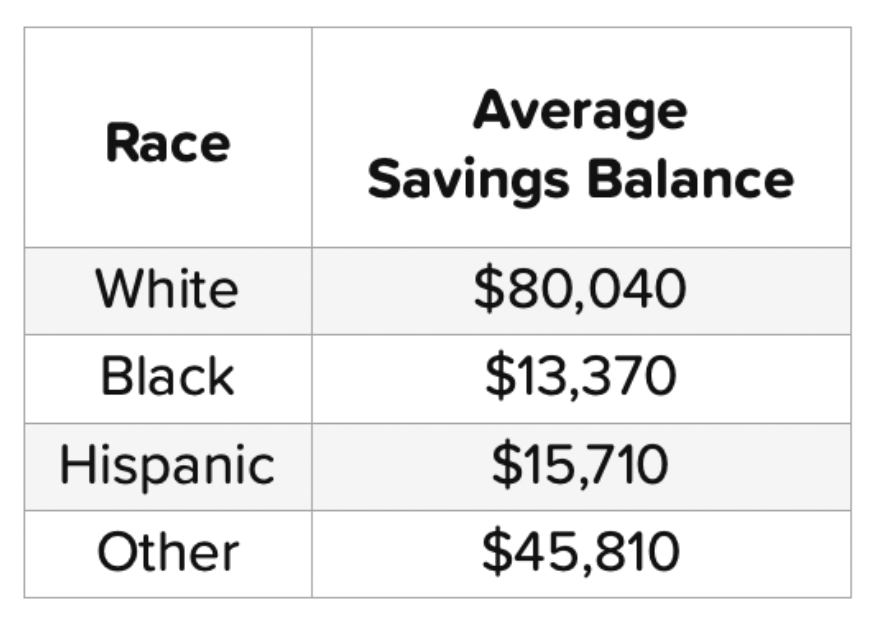

Average Savings Balance by Race

A large racial wealth gap still exists in America, from income to household wealth. According to data from the Federal Reserve, that gap flows into savings balances as well.

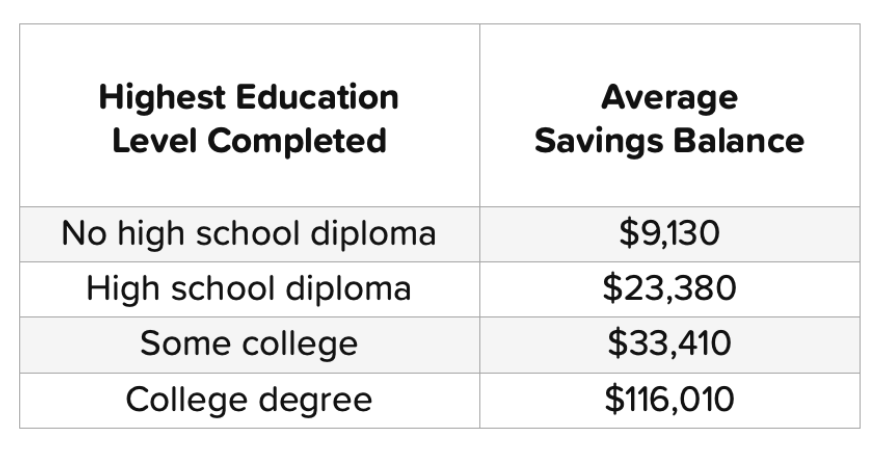

Average Savings Balance by Education Level

As a family's education level increases, so does the average savings balance. People who earned a high school diploma have an average savings balance double that of those who haven't. Similarly, people with a college degree have an average savings balance about five times greater than that of someone who only completed high school.

Here's how education affects savings balance, according to the 2022 Survey of Consumer Finances:

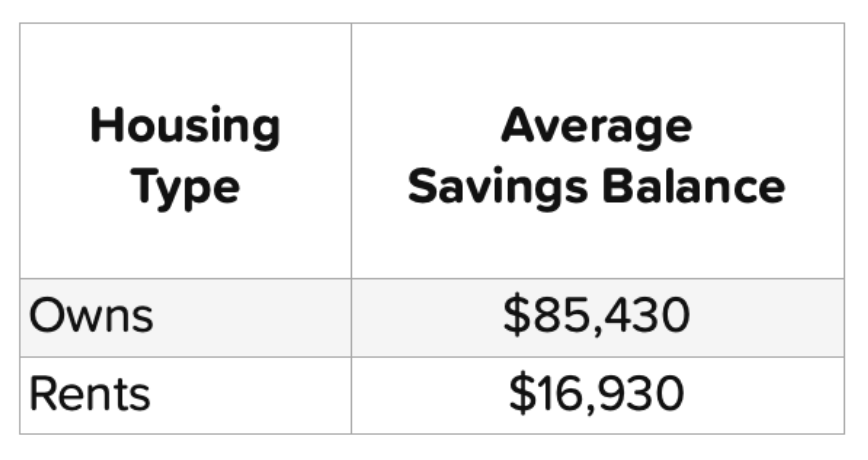

Average Savings Balance by Homeownership

People who own homes tend to save more, on average, than people who own homes have more cash in the bank than those who rent, according to Federal Reserve data.

Average American Savings Balances

The average American savings balance can vary greatly depending on your circumstances. Numerous factors, such as age, household size, race, education level, and homeownership status can impact how much you've saved.

Also, keep in mind that the data we've included from the Federal Reserve's 2022 Survey of Consumer Finances doesn't not factor in retirement accounts, and represents an average savings balance of high-income and low-income American families.

While saving for retirement and other goals is important, so is saving for potential emergencies. Emergency savings prevent you from having to take out a loan or use a credit card to cover unexpected expenses.

Unfortunately, not all Americans are financially prepared for an emergency.

According to the Making Ends Meet Survey and Consumer Credit Panel from the Consumer Financial Protection Bureau (CFPB) conducted in 2022, 24% of Americans don’t have any money saved for emergencies. And while 37% reported having at least a month’s worth of income in emergency savings, 39% reported having less than this.

Setting money aside for emergencies can have a significant impact on overall financial well-being, and data suggests an upward trend in emergency preparedness in the U.S. A 2021 report by the Federal Reserve on the economic well-being of U.S. households found that adults who said they could cover a small emergency expense using cash increased to 68% in 2021, up from 50% in 2013.

Average Emergency Savings

How much you should save for emergencies depends on a number of factors, but many Americans are saving $5,000 or less. The Transamerica Institute found the median emergency savings to be $5,000 as of late 2021, with over a third (34%) of Americans reporting saving less.

A few thousand dollars could help in many situations, but it may not be enough if you’re faced with back-to-back emergencies—or one very costly one.

How Much Emergency Savings Should I Have?

As a general rule, experts suggest keeping at least three to six months’ worth of living expenses in an emergency fund. But the ideal amount of emergency savings for you depends on your expenses and financial situation, and certain risk factors may require you to save more. For example, if you have dependents, low job security or a fluctuating income, a larger emergency fund could be helpful.

If you can’t save three to six months’ worth of expenses right away, save what you can now and contribute more when you can afford to. Starting somewhere is better than not starting at all.

Retirement Savings Statistics

As of September 2022, the Investment Company Institute found that 401(k) plans hold a combined $6.3 trillion in assets in across 625,000 plans. This encompasses millions of participants and retirees.

According to further data, while around three-fourths of non-retired adults were found to have some retirement savings, 28% had none. Unfortunately, this percentage was up from 25% in 2021.

401(k) plans aren’t the only place Americans are stashing retirement savings. While 54% of non-retired adults have their retirement savings in defined contribution plans like 401(k) or 403(b) plans, 47% have retirement savings outside of formal retirement accounts.

And just because money is earmarked for retirement doesn’t mean it never gets spent on other things. An economic well-being survey of U.S. households conducted by the Federal Reserve in 2023 found that 8% of non-retired adults tapped their retirement savings to cover an emergency in 2022.

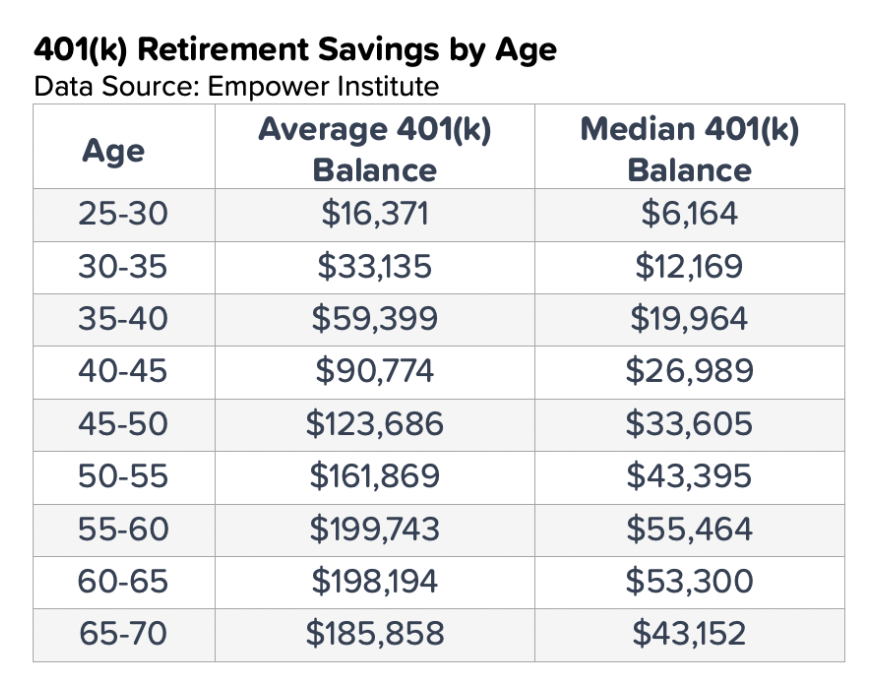

What Is the Average Retirement Savings?

Average savings vary by age. This makes sense not only because savings ideally grow over time rather than shrink, but also because people usually earn less early in their careers than they will later on.

According to data from Empower (formerly the Empower Institute) in 2022, the average 401(k) account balance is $118,781 across all ages. However, the median account balance is much lower—only $32,689 across all ages. The average balance increases with each subsequent age group until the 60 to 65 age group, when many workers retire and begin to make withdrawals from their 401(k)s.

How Much Retirement Savings Should I Have?

The amount of money you need to save for retirement depends primarily on your life expectancy, the age at which you’ll retire and your spending habits.

An analysis by Fidelity Investments provides some general guidelines for defining this. These guidelines suggest you should have one times the amount of your salary saved by age 30, three times by age 40, six times by age 50, eight times by age 60 and 10 times your salary by age 67.

According to Fidelity, these figures assume you save at least 15% of your income annually starting at age 25, invest an average of 50% of your savings in stocks over your life and plan to retire at age 67 without inflating your lifestyle in retirement.

How To Maximize Retirement Savings

The average U.S. retirement savings balance in a 401(k) plan is $118,701, but the median is only $32,689. This means many individuals likely fall short of the targets laid out above. Especially for those not saving enough, it’s important to understand how to maximize retirement savings.

The sooner you start saving for retirement, the more likely you are to retire with enough—or more than enough—cash to cover your expenses. If you’re one of the 28% of non-retired Americans with no retirement savings, start saving today.

Aside from starting as early as you can, here are a few tips for maximizing your retirement savings:

- Contribute enough to your workplace retirement plan for employer matching. If your employer offers a match on retirement contributions, don’t let that free money slip away. Contribute at least as much as you need to receive the full match. For example, if your employer matches up to 5% of your salary, contribute at least 5%.

- Contribute to other tax-deferred accounts. In addition to using your workplace retirement plan, there are other accounts you can open to build retirement savings. Consider a traditional IRA, Roth IRA or health savings account (HSA) for tax-advantaged savings. If you’re maxed out on these accounts, you can always funnel extra savings into a taxable brokerage account.

- Make catch-up contributions if you’re over age 50. When you reach age 50, the IRS allows you to make extra contributions to your retirement accounts, including both 401(k) plans and IRAs, to help bolster your savings. If you started late or fell behind with your retirement savings, you can get back on track by making catch-up contributions up to the annual limits.

A January 2023 survey by Forbes Advisor on financial regrets and successes uncovered interesting data about U.S. consumer savings trends. It found that the most common financial habit Americans planned to adjust in 2023 was tracking spending/creating a budget (43%). Americans also indicated wanting to save more and spend less. The next three most popular responses participants gave were spending below their means (40%), paying down debt (37%) and adding to emergency funds (25%).

This survey also found that 56% of Americans who experienced financial regret in 2022 cited not saving more money as one of their top three misgivings. Meanwhile, 57% of Americans who experienced financial success named increasing their savings as one of their top three triumphs.

Forbes Advisor also conducted a survey in March 2023 to analyze how often Americans save and what methods they use. When it comes to putting the habit of saving into practice, 44% of Americans use recurring transfers to save automatically, 38% allocate a portion of their pay directly into a savings account and 35% manually transfer their funds. Some use a combination of methods to save.

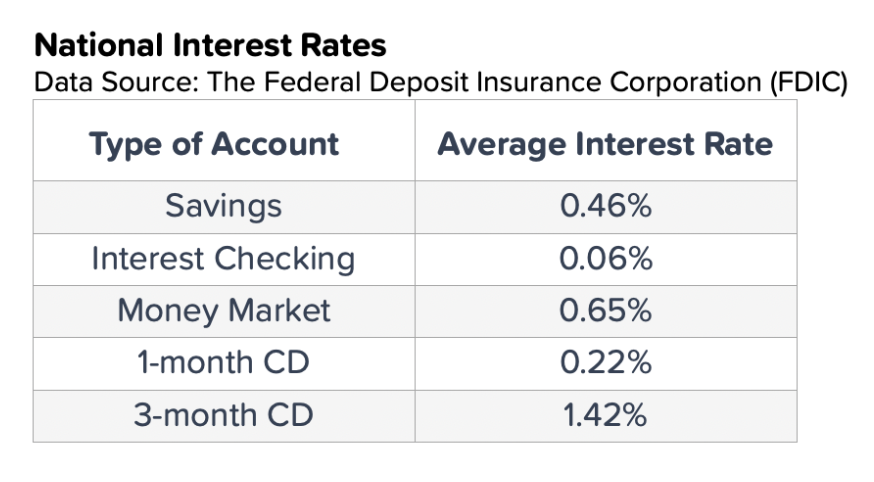

Current Savings Account Rates

Research suggests that interest rate hikes encourage Americans to save. But even though savings account interest rates have been on the rise, they still vary widely from bank to bank. Below is a look at national interest rates as of November, 2023.

The average savings account rate is a benchmark for the overall interest-rate environment, but it’s not a rate you should settle for.

Rather, aim for an annual percentage yield (APY) many times the national average, such as those offered by high-yield savings accounts. It’s easy to find a high-yield savings account that offers a competitive return with a no or low minimum balance requirement.

National Interest Rates

Data Source: The Federal Deposit Insurance Corporation (FDIC)

Start Saving Money

With a dramatic drop in Americans’ personal savings rates over the past couple of years as well as clear indications that many want to save more, there’s no doubt that saving is easier said than done.

Saving is important for achieving financial freedom and confidence. This requires little convincing, but it can be difficult to know where to start. Use these tips to cut down costs and boost your savings:

- Pay off high-interest debt first. The less money you need to throw at your debt, the more you can funnel toward your savings goals. Start by paying off your high-interest debt first, including credit card debt and loans, because it is often the costliest. Try to make more than the minimum payments and focus on the debt that costs you the most first.

- Track your spending and create a budget. If you’re not already using a budget, try it now. Start by tracking your spending to see where your money goes each month. Based on this information and your savings goals, create a budget that includes all of your income and expenses. Look for areas where you can redirect spending toward savings and debt payoff.

- Automate savings wherever possible. If you want to save without needing to think about it, automation is key. Automate monthly or weekly transfers from checking to savings and set up automatic contributions into your workplace retirement account. Start with however much you can afford, even if it’s not a lot. Increase contributions as your paycheck and budget allow.

- Plan for large expenses. When you allow large expenses to sneak up on you, they can derail your budget, empty your savings or force you to take on high-interest debt. Instead, do a little planning for significant spending. List large and irregular expenses like car registration costs and vacations and break them down into monthly savings goals. Include these in your budget.

- Take advantage of high-yield savings accounts. When you’re working hard to save money, a competitive interest rate can accelerate the process. To get the most from your savings, put your cash in a high-yield savings account instead of a traditional savings account. High-yield savings account rates beat national averages and tend to offer more flexibility and tools.

Bottom Line

In recent years, particularly throughout 2021 and 2022, there has been a noticeable uptick in the average balances of American savings accounts, a trend that seemed to signal a positive shift in savings behavior. However, this increase in savings account balances doesn't fully capture the broader picture of American financial habits. Despite these initial gains, the overall proportion of income that Americans are saving has diminished, with many individuals finding themselves underprepared for emergency situations.

At the same time, the financial landscape is evolving. Interest rates have climbed to their highest levels in 15 years, offering consumers a more favorable environment for saving money efficiently. This shift presents a valuable opportunity for those aiming to bolster their savings and emergency funds, aligning with the aspirations of many to improve their financial resilience.

However, the journey to effective saving is fraught with challenges and can be influenced by many factors. Key among these are age, geographic location, income levels, and spending habits, all of which play a crucial role in determining your ability to set aside funds for unforeseen expenses, retirement, and other financial objectives.

Despite these challenges, there are strategies and tools available that can greatly assist in the pursuit of financial security. Leveraging tax-advantaged accounts, investing in high-yield savings options, and implementing automatic transfers are just a few of the methods that can facilitate more effective saving. When these tools are utilized, especially from an early age, they can significantly enhance one's ability to meet both short-term needs and long-term financial aspirations.

While the path to saving is complex and varied, understanding the current economic context, recognizing the individual factors that impact saving capabilities, and employing strategic financial tools can collectively empower individuals to make substantial strides towards achieving their financial goals.

.png)